- Occidental Petroleum spiked 9% on Thursday after Berkshire Hathaway increased its stake in the oil company.

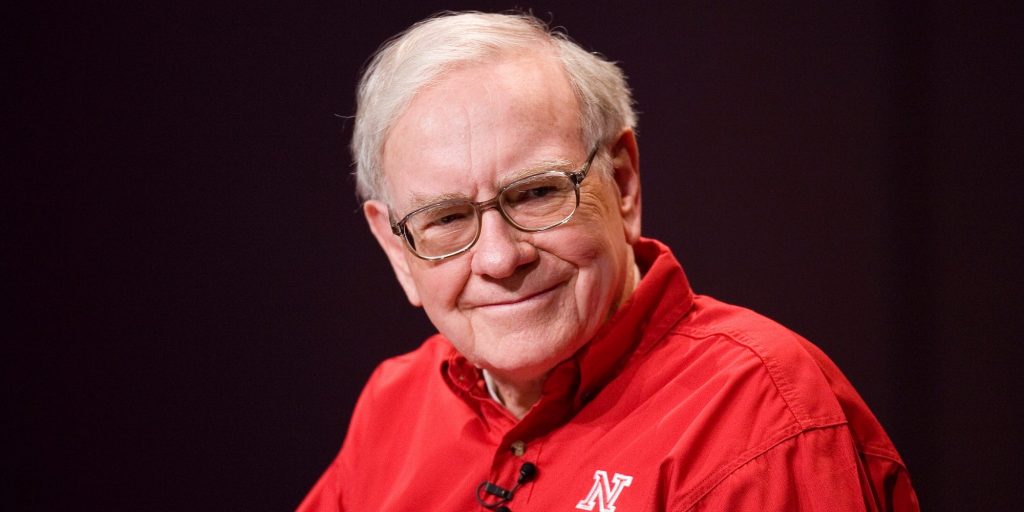

- The conglomerate led by Warren Buffett purchased $1 billion Occidental shares this week, and has purchased $7 billion in shares this month.

- Occidental Petroleum has rallied more than 160% from its 52-week low as oil prices surge.

Occidental Petroleum stock soared as much as 9% on Thursday after Warren Buffett's Berkshire Hathaway purchased another $1 billion stake in the oil and gas producer this week.

So far this month, Berkshire has purchased about $7 billion worth of Occidental shares, adding to its exposure as the company benefits from a surge in oil prices. Buffett now owns a 15% stake as of Wednesday's close, and there's a good chance that stake could get even bigger.

Buffett originally received warrants and preferred stock in Occidental Petroleum in 2019 as the oil company struggled to find traditional financing required to complete its $38 billion acquisition of Anadarko Petroleum, which was mostly a cash deal due to Occidental's floundering stock price at the time.

But shares of Occidental Petroleum are now reaching levels not seen since early 2019, with the stock up more than 160% from its 52-week low to $57.79. And that means Buffett's 83.9 million Occidental warrants that have an exercise price of $59.62 are nearly in the money.

The warrants give Buffett the right to buy 83.9 million shares of Occidental at $59.62 per share, regardless of what the current or future stock price trades at. If shares of Occidental zoom past the $60 level, it means Buffett can exercise the warrants to buy the stock and then sell it for an immediate profit.

Given Buffett's usual long-term time horizon and his recent buying spree in Occidental shares, it's likely he'll choose to hold onto the stake rather than flip it for a quick profit. It would cost an additional $5 billion for Buffett to exercise his Occidental warrants and purchase the shares, which is more than doable given Berkshire Hathaway's most recent cash pile of almost $150 billion.

Shares of Occidental have rallied amid an ongoing surge in oil prices, which has been exacerbated by Russia's attack against Ukraine. Those higher oil prices, if sustained, should help Occidental reduce its debt burden, which skyrocketed after the company acquired Anadarko in 2019.

Occidental produces about 1.2 million barrels of oil per day. The stock is up 83% year-to-date.